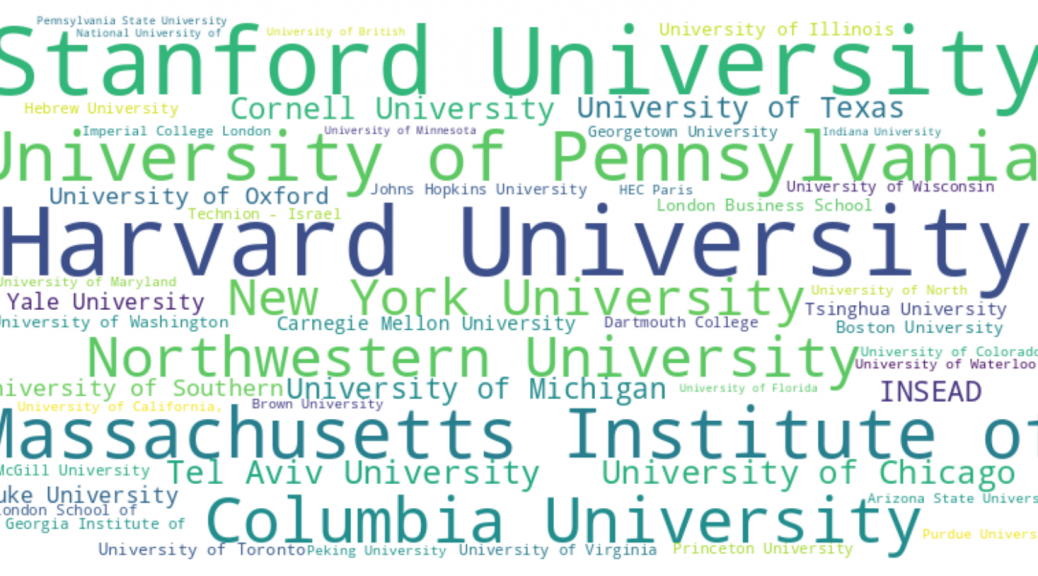

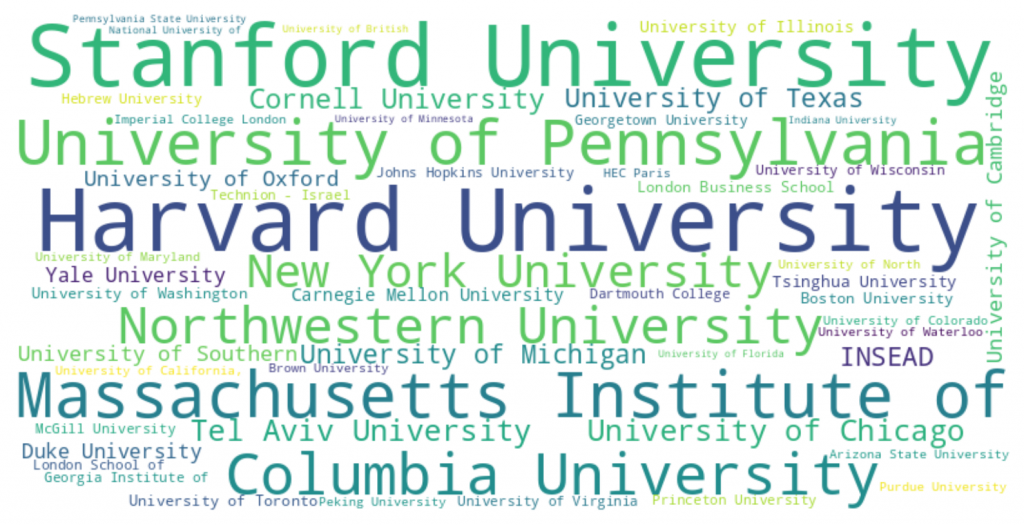

How Top Universities Fuel Startups with Venture Capital

Top Universities Driving Global Startups Through Venture Capital: A Data-Backed Overview

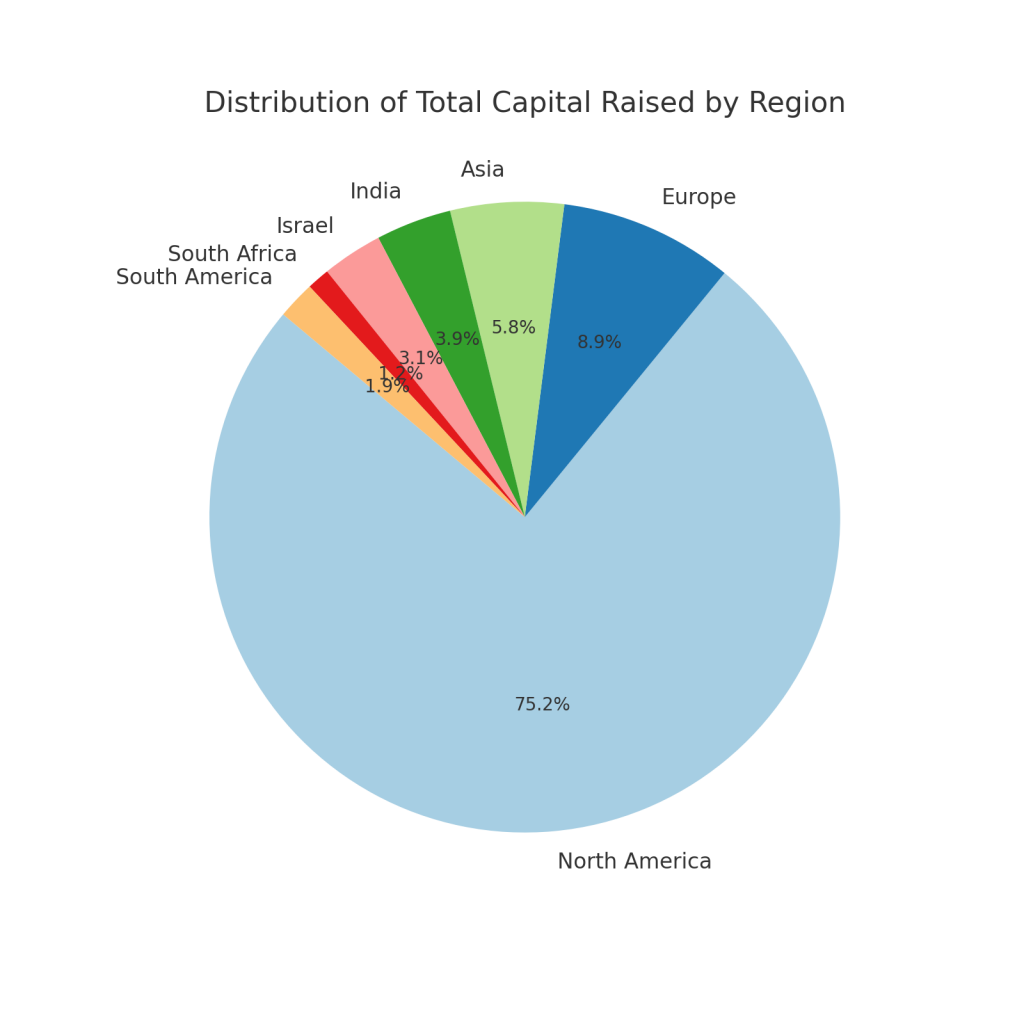

Universities play a pivotal role in nurturing talent and fostering innovation, and the success of alumni-founded startups is a testament to the entrepreneurial culture present in these institutions. A recent analysis of venture capital funding across top universities reveals the strong influence of academic ecosystems on startup success. This article dives into the top 50 universities based on the venture capital raised by their alumni, explores key geographical trends, highlights key sectors, and references publicly available data to give a comprehensive view.

The Global Leaders: U.S. Universities Dominate the Startup Landscape

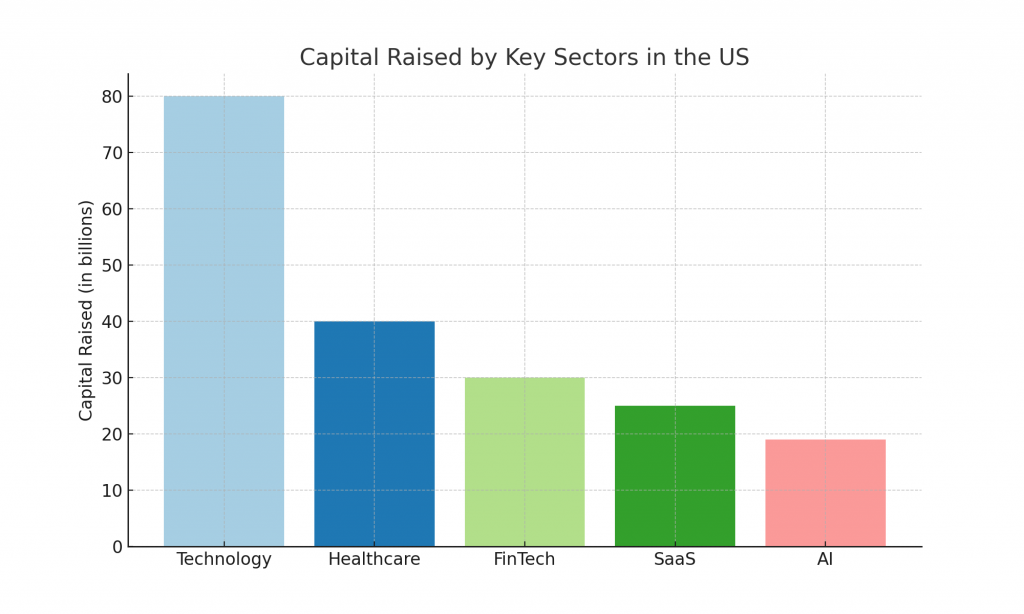

Key Statistics (U.S.):

- Total Dollars Raised: $194 billion

- Number of Companies Founded: 4,000+

- Key Sectors: Technology, Healthcare, FinTech, SaaS, AI

According to Crunchbase and PitchBook data, U.S. universities such as Stanford University, Harvard University, and the University of California, Berkeley lead the pack in terms of venture capital raised and the number of companies founded. These institutions have produced successful ventures in technology, artificial intelligence, and SaaS (Software as a Service). Stanford’s proximity to Silicon Valley has helped drive the innovation boom, particularly in tech startups.

Some of the most notable startups originating from these institutions include:

- Stanford University: Renowned for its close ties to Silicon Valley, Stanford is the birthplace of giants like Google (founded by Larry Page and Sergey Brin), Yahoo (founded by Jerry Yang and David Filo), and WhatsApp (co-founded by Brian Acton).

- Harvard University: With alumni like Mark Zuckerberg (co-founder of Facebook) and Bill Gates (co-founder of Microsoft), Harvard is a key player in tech, biotech, and healthcare sectors. Startups like Cloudflare (founded by Matthew Prince) also emerged from Harvard.

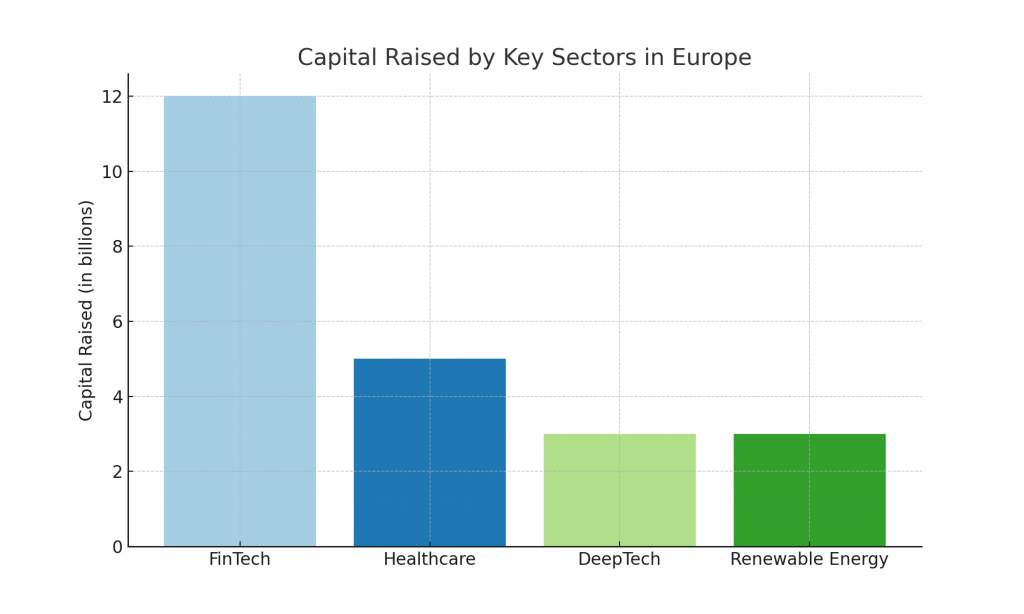

Europe: A Growing Hub for Innovation

Key Statistics (Europe):

- Total Dollars Raised: $23 billion

- Number of Companies Founded: 500+

- Key Sectors: FinTech, Healthcare, DeepTech, Renewable Energy

Europe has seen rapid growth in FinTech, deep tech, and renewable energy sectors. INSEAD and Cambridge University stand out as key contributors to the startup ecosystem. According to Dealroom.co, FinTech is particularly dominant, with startups like Revolut and TransferWise leading the way.

INSEAD alumni have raised over $23 billion, with many startups thriving in FinTech and consulting sectors. A standout example is BlaBlaCar, a ridesharing platform co-founded by Frédéric Mazzella that has transformed travel across Europe by offering affordable long-distance ride-sharing options.

University of Cambridge has contributed significantly to deep tech and healthcare innovations, producing companies like Arm Holdings, the semiconductor giant. Mike Lynch, founder of Autonomy, is another Cambridge alumnus who has disrupted the tech industry.

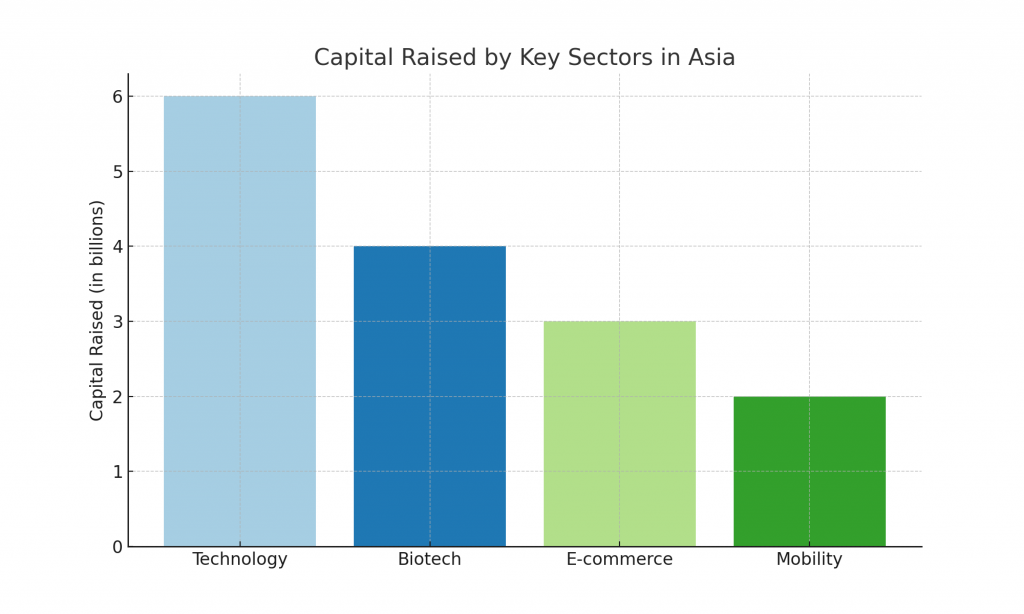

Asia: A Rising Force in the Startup World

Key Statistics (Asia):

- Total Dollars Raised: $15 billion

- Number of Companies Founded: 1,200+

- Key Sectors: Technology, Biotech, E-commerce, Mobility

Asia, led by universities like the National University of Singapore (NUS) and Tsinghua University, is rapidly becoming a hotbed for biotech, e-commerce, and mobility startups. NUS has seen its alumni raise billions in venture capital, particularly in the tech sector. According to TechInAsia, NUS-produced startups like Grab, co-founded by Anthony Tan and Tan Hooi Ling, have dominated the Southeast Asian ride-hailing market.

In China, Tsinghua University has been integral in fostering technological advancements, with alumni like Charles Zhang, founder of Sohu, shaping the Chinese tech landscape. The university has become synonymous with engineering and tech entrepreneurship.

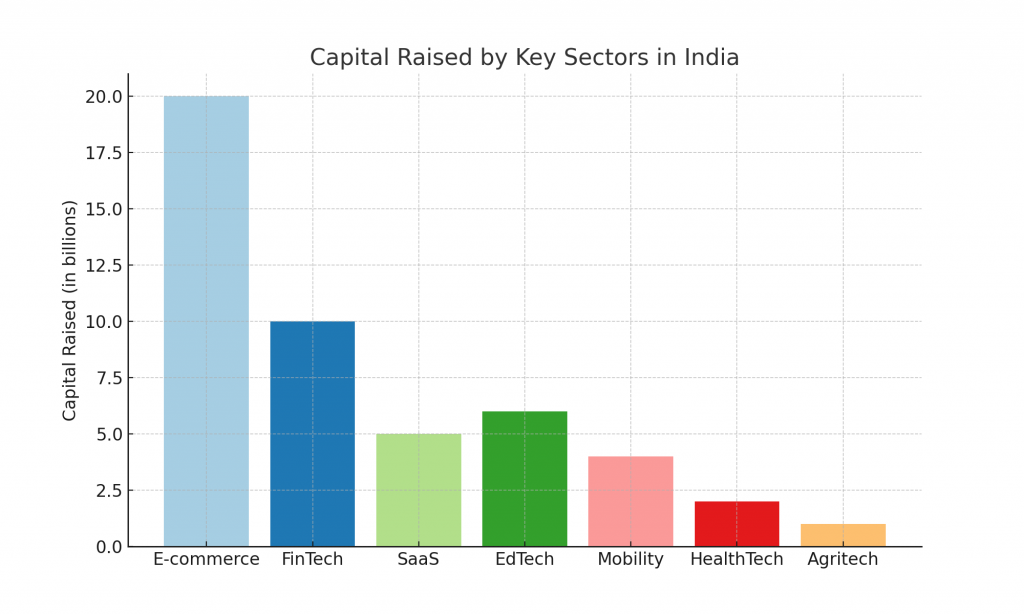

Startups in India: The IIT Ecosystem

Key Statistics (India):

- Total Dollars Raised: $10 billion

- Number of Companies Founded: 800+

- Key Sectors: E-commerce, FinTech, SaaS, Mobility

The Indian Institutes of Technology (IITs), particularly IIT Bombay and IIT Delhi, are pivotal in India’s e-commerce, FinTech, and mobility sectors. According to Inc42, startups like Flipkart (co-founded by Sachin Bansal and Binny Bansal, both IIT Delhi graduates) and Zomato (Founded by Deepinder Goyal, IIT Delhi) are reshaping the Indian market and attracting substantial venture capital.

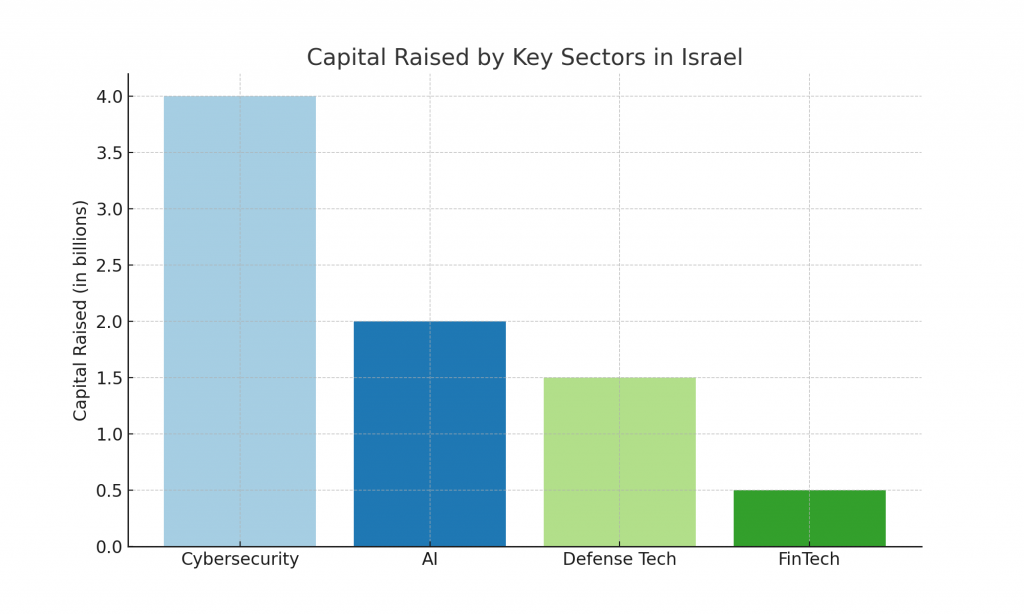

Israel: A Thriving Startup Nation

Key Statistics (Israel):

- Total Dollars Raised: $8 billion

- Number of Companies Founded: 600+

- Key Sectors: Cybersecurity, AI, FinTech, Defense Tech

Israel, often referred to as the Startup Nation, has made a name for itself with innovation in cybersecurity and AI. Universities like the Hebrew University of Jerusalem and the Technion – Israel Institute of Technology have been critical in producing world-class startups. For instance, Waze, the navigation app acquired by Google, was co-founded by Ehud Shabtai, an alumnus of Tel Aviv University. The country’s deep focus on cybersecurity is also reflected in companies like Check Point Software Technologies, founded by Gil Shwed, a Technion graduate.

South Africa: Emerging in FinTech and E-commerce

Key Statistics (South Africa):

- Total Dollars Raised: $3 billion

- Number of Companies Founded: 150+

- Key Sectors: FinTech, E-commerce, Agriculture

While South Africa may not boast the same number of startups as Silicon Valley, it has a growing presence in FinTech and e-commerce. Universities like the University of Cape Town have played a significant role in this growth. One notable company is Yoco, a FinTech startup co-founded by Katlego Maphai, which provides payment solutions for small businesses across Africa. South Africa is also a key player in agri-tech, with startups focusing on modernizing the agricultural supply chain.

South America: A Rising Contender in E-commerce and FinTech

Key Statistics (South America):

- Total Dollars Raised: $5 billion

- Number of Companies Founded: 500+

- Key Sectors: E-commerce, FinTech, PropTech

South America, particularly Brazil and Argentina, has seen a significant rise in e-commerce and FinTech startups. Universities like Universidade de São Paulo and Universidad de Buenos Aires have contributed to this burgeoning ecosystem. Companies like MercadoLibre, co-founded by Marcos Galperin (Universidad de Buenos Aires alumnus), are leading the e-commerce revolution in the region, while Nubank, a FinTech unicorn co-founded by David Vélez, is transforming banking in Latin America.

Why Are These Regions Underrepresented in the Data?

While regions like Israel, South Africa, and South America are seeing growth in venture capital-backed startups, the numbers are still significantly smaller compared to the U.S. and Europe. This can be attributed to a smaller pool of venture capital available, fewer universities with established entrepreneurial ecosystems, and the nascent state of the venture capital markets in these regions. However, they are catching up quickly, and with increasing global attention, these regions are likely to play a larger role in the global startup ecosystem in the coming years.

Conclusion

The data paints a clear picture of the crucial role universities play in fostering entrepreneurship and innovation globally. While U.S. institutions like Stanford and Harvard continue to dominate the startup landscape, the rise of universities in Europe, Asia, and emerging regions such as Israel and South America signals a significant shift toward a more diversified and competitive global startup ecosystem. This is no longer just a Silicon Valley story.

European universities are making strides in deep tech and FinTech, while Asian institutions are positioning themselves at the forefront of sectors like e-commerce, mobility, and biotech. These regions, once considered underrepresented in venture capital, are rapidly scaling their entrepreneurial impact, thanks to increasingly robust academic ecosystems, governmental support, and access to global venture networks.

However, as these newer hubs mature, it becomes clear that the presence of an established entrepreneurial culture, combined with strong alumni networks and well-supported innovation hubs, is key to sustaining long-term growth. For universities aspiring to drive the next generation of unicorns, investing in interdisciplinary research, fostering global collaborations, and creating pipelines between academia and industry will be critical in the years ahead.

The entrepreneurial landscape is rapidly evolving, and universities that align themselves with this shift will not only fuel economic growth but will also shape the future of technology, healthcare, and innovation on a global scale. As venture capital continues to flow into emerging markets, the next wave of disruptive startups may very well come from unexpected regions, further diversifying the global innovation economy.

References:

- Crunchbase – Crunchbase Venture Capital Database

Crunchbase is a comprehensive database of startup companies, venture capital firms, and funding rounds, offering insights into global startup ecosystems and venture trends. - PitchBook – PitchBook Data

PitchBook provides detailed reports on venture capital, private equity, and mergers & acquisitions, offering in-depth insights into sector-specific funding and university-driven startups. - Dealroom.co – Dealroom European Startup Data

Dealroom is a leading platform for discovering startups, scale-ups, and investment trends, particularly in the European startup ecosystem. - TechInAsia – Tech in Asia Startup Data

A platform dedicated to startup news and insights from Asia, providing information about venture capital, company profiles, and technology trends across the region. - Inc42 – Inc42 Indian Startup Ecosystem

Inc42 is a leading source for insights on the Indian startup ecosystem, offering reports on funding, growth trends, and key sectors like FinTech, SaaS, and E-commerce. - CB Insights – CB Insights Global Venture Capital

CB Insights is a market intelligence platform that tracks venture capital investments, industry insights, and emerging trends, providing data-driven analysis on startups and sectors. - NASSCOM – Indian Tech Startup Ecosystem Report

NASSCOM publishes reports on India’s growing startup ecosystem, covering key sectors, venture capital inflows, and the impact of technology-driven ventures. - TechCrunch – TechCrunch Global Startup News

A leading news outlet for global startup and venture capital news, TechCrunch reports on funding rounds, sector trends, and university-linked startup initiatives.

Further Reading:

- “The Startup Playbook: Secrets of the Fastest-Growing Startups from Their Founding Entrepreneurs” by David Kidder

This book provides insights into how successful entrepreneurs built their startups from scratch, with lessons applicable to university-driven ventures. - “The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses” by Eric Ries

A fundamental resource for aspiring entrepreneurs, this book explains how to develop successful startups using the Lean methodology, which has been widely adopted by university-driven startups. - “Zero to One: Notes on Startups, or How to Build the Future” by Peter Thiel and Blake Masters

Peter Thiel’s insights as a co-founder of PayPal and an investor in numerous startups, including Facebook, provide valuable lessons on startup growth and innovation. - “Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies” by Reid Hoffman

This book by LinkedIn co-founder Reid Hoffman focuses on the strategy of rapidly scaling companies, a key concept for university startups aiming for exponential growth. - “Startup Nation: The Story of Israel’s Economic Miracle” by Dan Senor and Saul Singer

This book dives deep into how Israel became a global leader in innovation, especially in sectors like cybersecurity and defense technology, driven by university programs. - Global Startup Ecosystem Report (GSER) by Startup Genome

This annual report highlights trends in global startup ecosystems, including the role universities play in driving innovation and venture capital flows. - McKinsey & Company – Venture Capital’s Role in Innovation

McKinsey’s reports provide a comprehensive overview of how venture capital supports startups and fosters innovation, with special focus on key regions like the US, Europe, and Asia.