Is the AI Boom Overhyped? A Look at Potential Challenges

Introduction:

The rapid development of Artificial Intelligence (AI) has fueled excitement and hyper-investment. However, concerns are emerging about inflated expectations, not just the business outcomes, but also from the revenue side of the things.. This article explores potential challenges that could hinder widespread AI adoption and slow down the current boom.

The AI Hype:

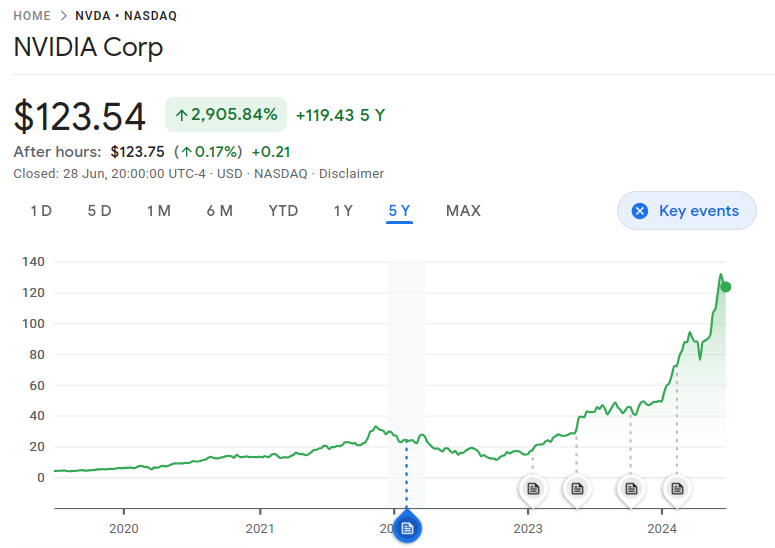

AI has made significant strides, but some experts believe we might be overestimating its near-future capabilities. The recent surge in AI stock prices, particularly Nvidia’s, reflects this optimism. Today, it’s the third-most-valuable company globally, with an 80% share in AI chips—processors central to the largest and fastest value creation in history, amounting to $8 trillion. Since OpenAI released ChatGPT in October 2022, Nvidia’s value has surged by $2 trillion, equivalent to Amazon’s total worth. This week, Nvidia reported stellar quarterly earnings, with its core business—selling chips to data centres—up 427% year-over-year.

Bubble Talk:

History teaches us that bubbles form when unrealistic expectations drive prices far beyond a company or a sector’s true value. The “greater fool theory” explains how people buy assets hoping to sell them at a higher price to someone else, even if the asset itself has no inherent value. This mentality often fuels bubbles, which can burst spectacularly. I am sure you’ve read about the Dutch Tulip Mania, if not please help yourself to an amusing read here and here.

AI Bubble or Real Deal?:

The AI market holds undeniable promise, but is it currently overvalued? Let’s look at past bubbles for comparison:

- Dot-com Bubble: The Internet revolution was real, but many companies were wildly overvalued. While some thrived, others crashed. – Crazy story about the dotcom bubble

- Housing Bubble: Underlying factors like limited land contributed to the housing bubble, but speculation inflated prices beyond sustainability.

- Cryptocurrency Bubble: While blockchain technology has potential, some cryptocurrencies like Bored Apes were likely fueled by hype rather than utility.

The AI Bubble’s Fragility:

The current AI boom shares similarities with past bubbles:

- Rapid Price Increases: AI stock prices have skyrocketed, disconnected from current revenue levels.

- Speculative Frenzy: The “fear of missing out” (FOMO) mentality drives new investors into the market, further inflating prices.

- External Factors: Low interest rates can provide cheap capital that fuels bubbles.

Nvidia’s rich valuation is ludicrous — its market cap now exceeds that of the entire FTSE 100, yet its sales are less than four per cent of that index

The Coming Downdraft?

While AI’s long-term potential is undeniable, a correction is likely. Here’s one possible scenario:

- A major non-tech company announces setbacks with its AI initiatives. This could trigger a domino effect, leading other companies to re-evaluate their AI investments.

- Analyst downgrades and negative press coverage could further dampen investor confidence.

- A “stampede for the exits” could ensue, causing a rapid decline in AI stock prices.

Learning from History:

The dot-com bubble burst when economic concerns spooked investors. The housing bubble collapsed when it became clear prices were unsustainable. We can’t predict the exact trigger for an AI correction, but history suggests it’s coming.

The Impact of a Burst Bubble:

The collapse of a major bubble can have far-reaching consequences. The 2008 financial crisis, triggered by the housing bubble, offers a stark reminder of the potential damage.

Beyond the Bubble:

Even if a bubble bursts, AI’s long-term potential remains. Here’s a thought-provoking comparison:

- Cisco vs. Amazon: During the dot-com bubble, Cisco, a “safe” hardware company, was seen as a better investment than Amazon, a risky e-commerce startup. However, Amazon ultimately delivered far greater returns.

Conclusion:

While the AI boom is exciting, it’s crucial to be aware of potential bubble risks. Investors should consider a diversified portfolio and avoid chasing short-term gains. Also please be wary of the aftershocks. Even if the market corrects by 20% or even 30% the impact won’t be restricted to AI portfolios. There would be a funding winter of sorts, hire freezes and all the broader ecosystem impacts.

The true value of AI will likely be revealed after the hype subsides.

References and Further Reading

- Precedence Research – The Growing AI Chip Market

- Bloomberg – AI Boom and Market Speculation

- PRN – The AI Investment Surge

- The Economist – AI Revenue Projections

- Russel Investments – Understanding Market Bubbles

- CFI – Dutch Tulip Market Bubble