The Need for Privacy: Lessons from Pavel Durov’s Arrest

The Imperative for Decentralization and Privacy Protection Amid Tech Dominance and State Control

The arrest of Telegram CEO Pavel Durov has brought to light the escalating tension between state power and digital freedom, underscoring the urgent need for decentralization and robust privacy protections. This incident is not isolated but rather part of a broader pattern of state interference in media and technology, a trend with historical roots and contemporary relevance.

Historical Context: Press Censorship and Propaganda

Governments have long sought to control media to shape public opinion and further their agendas. During World War II, the British government manipulated the BBC to spread propaganda and disinformation that supported the Allied war effort. This manipulation of media was crucial in maintaining public morale and deceiving enemy forces. Similarly, during the Cold War, both Western and Soviet blocs used media as a tool for ideological warfare, demonstrating the power of information control.

These historical precedents are echoed today in the digital realm, where governments attempt to exert similar control over social media and online platforms. The difference now is the scale and speed at which information can be disseminated or suppressed. Additionally, the power dynamics have shifted, with technology companies themselves becoming significant players on the global stage.

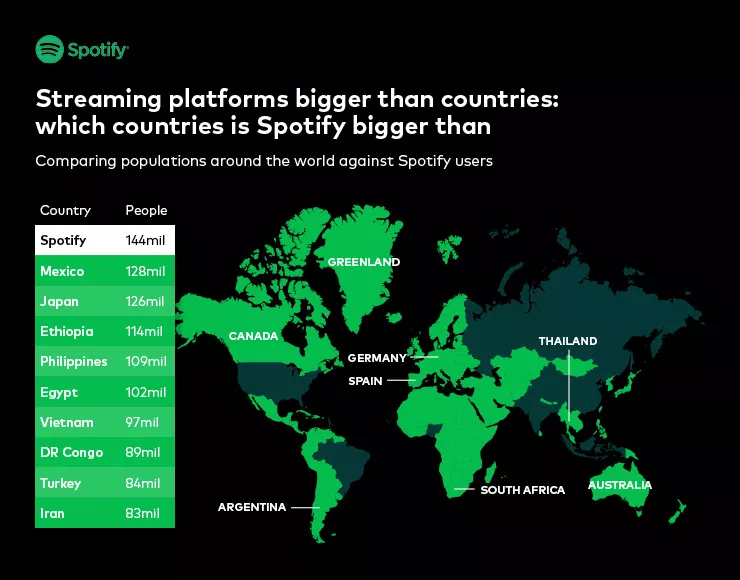

Today’s tech giants like Amazon, Apple, Microsoft, and Facebook wield economic power that rivals and even surpasses the GDPs of some nation-states. For instance, Amazon’s net worth of $1.6 trillion surpasses the GDP of countries like South Korea and Australia. Apple, with a net worth of $2.2 trillion, is worth more than Italy and Brazil. Microsoft’s valuation of $1.8 trillion eclipses Canada and Russia, while Facebook’s $763 billion net worth is comparable to Turkey and Switzerland.

This unprecedented concentration of wealth and influence positions these companies as powerful entities, capable of shaping global economic and political landscapes, much like nation-states. The implications of this shift in power are profound, as these companies have the ability to influence not just markets, but also information flows, societal norms, and governance structures worldwide.

Modern Digital Censorship: A Global Phenomenon

In the 21st century, the battleground for censorship has shifted from traditional media to digital platforms. Governments worldwide are increasingly pressuring tech companies like Telegram, TikTok, and Facebook to regulate content and hand over user data, often under the guise of national security. Durov’s arrest by French authorities, following Telegram’s refusal to comply with legal requests, exemplifies the growing tension between state demands and platform policies.

India, for instance, has frequently resorted to media censorship, particularly in times of political unrest. The Indian government has also been active in issuing DMCA content removal requests, targeting social media platforms and digital content that it deems problematic. This practice has raised concerns about the balance between national security and freedom of expression, especially as the government increasingly uses these powers to silence dissent and control the narrative.

India’s approach to media and digital content control mirrors the broader global trend of governments leveraging their regulatory powers to influence what information can be accessed and shared. The use of laws like the DMCA to force content removal is a modern extension of traditional censorship, adapted to the digital age.

The Global Origins of Tech Leaders and Their Impact

The international origins of many of today’s tech leaders further complicate the relationship between global platforms and state regulations. Pavel Durov, originally from Russia, is a significant example, having built Telegram with a strong emphasis on privacy and resistance to state intervention. Similarly, Zhang Yiming, the Chinese founder of TikTok, built a platform that has faced intense scrutiny and regulatory challenges in Western democracies, particularly over concerns related to data privacy and its ties to the Chinese government.

Meanwhile, BlueSky, originally envisioned by Twitter co-founder Jack Dorsey as a decentralized social network, is now run by Jay Graber, who aims to create an open protocol that moves away from the centralized control seen in traditional social media platforms. This initiative reflects the growing desire within the tech community to push back against centralized systems that are easily influenced by government mandates.

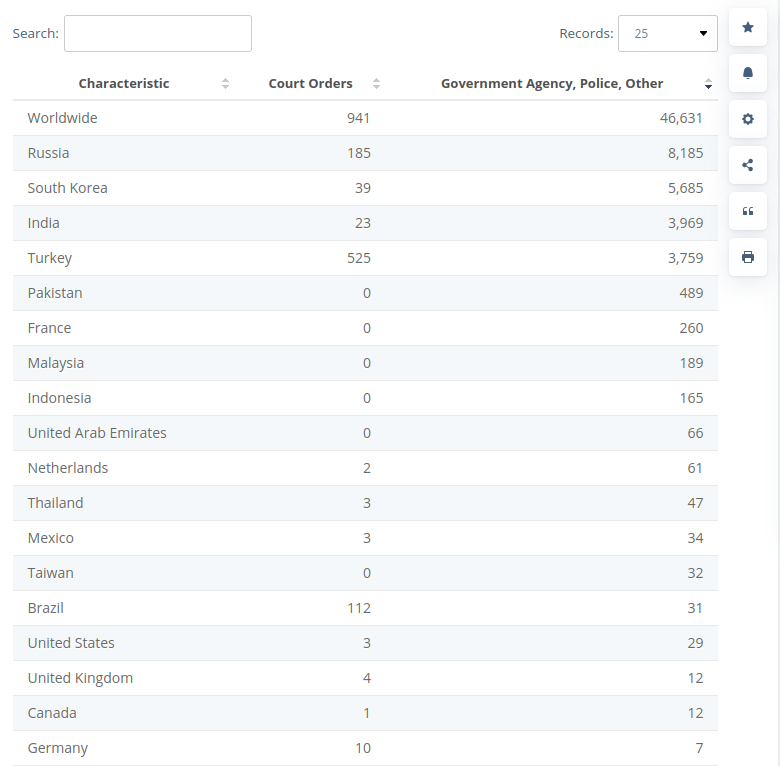

The impact of global tech leaders is evident in the way platforms are treated by different governments. For instance, various countries, including South Korea, China, and the USA, have issued significant numbers of government orders and requests for content removal. Russia leads with 8,185 government requests, while the United States has issued 29 and South Korea 5,685, demonstrating how even democratic governments actively engage in digital content control.

Table showing the number of data removal requests issued to X by country and institution. Source: https://www.statista.com/statistics/234858/number-of-requests-for-data-removal-from-twitter

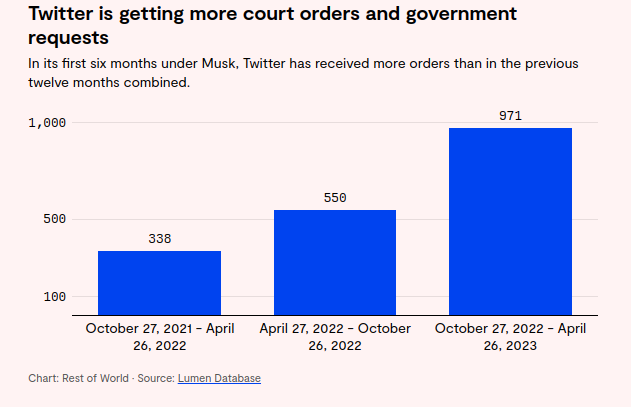

In the case of Twitter, as detailed in a recent article from Rest of World, Elon Musk’s management has seen the platform face an increasing number of government orders for content removal. While Twitter under Musk has claimed a commitment to free speech, the reality has shown a complex relationship with state power, where compliance with certain government demands is a necessity to continue operating in specific regions. This reflects a broader issue faced by tech companies globally: balancing the demands of state authorities with the principles of free expression and privacy.

The situation with Telegram further emphasizes this complexity. As reported by The Guardian and HuffPost, Durov’s arrest not only puts his platform at risk but also strengthens his image as a defender of digital freedom against authoritarian pressures. These sources suggest that the arrest could rally support around decentralized platforms as viable alternatives to the centralized giants currently dominating the market. (Remember Julian Assange)

These leaders and their platforms highlight the complex interplay between global tech entrepreneurship and state regulations. Unlike Western counterparts who may navigate regulatory frameworks with more ease, non-Western founders often face harsher scrutiny and legal challenges, as their platforms are perceived as threats to national security or public order in Western democracies.

The Case for Decentralization and Privacy Protections

The growing tension between state bureaucracy and tech dominance highlights the urgent need for decentralization and enhanced privacy protections. Centralized platforms, with their single points of control, are vulnerable to state coercion and censorship. Decentralized systems, on the other hand, distribute control across a network, reducing the risk of government overreach and ensuring that users retain control over their data and communications.

Decentralized technologies, such as blockchain and decentralized identity (DID) systems, provide a framework for maintaining user privacy and autonomy in an increasingly surveilled digital landscape. These technologies prevent governments from easily accessing user data and force platforms to comply with local laws that may infringe on individual freedoms.

Confronting Tech Dominance and State Overreach

The deep entanglement between tech giants and state power raises critical concerns about the future of digital freedom. As platforms like Telegram, TikTok, and BlueSky become integral to global communication, their influence over public discourse and individual privacy grows. Governments are increasingly leveraging legal and regulatory frameworks to enforce compliance, which in turn challenges the principles of free speech and privacy that these platforms were built on.

To protect the Internet as a space for free and open communication, there is a growing need to advocate for decentralized and privacy-focused alternatives. The push for decentralization is not just a technical challenge; it is a fundamental necessity to preserve digital autonomy and resist the consolidation of power by both state and corporate interests.

Conclusion

Pavel Durov’s arrest is more than an isolated incident; it is emblematic of the broader struggles facing the digital world today. As state bureaucracy tightens its grip on digital platforms and tech giants extend their influence into state affairs, the need for decentralized and privacy-focused alternatives becomes increasingly urgent. The future of digital freedom hinges on our collective ability to shift away from centralized systems and toward a decentralized, user-centric internet. Only then can we ensure that the internet remains a space for free and open communication, untainted by the heavy hand of censorship and control.

References and Further Reading

- The Telegram CEO’s Arrest Highlights the Urgent Need for Decentralization and Privacy Protections – Medium

- The Verge: Telegram CEO Pavel Durov’s Arrest Raises Red Flags

- Rest of World: Elon Musk, Twitter, and Government Orders

- NDTV: Why Telegram CEO Pavel Durov’s Arrest Raises Red Flags for Tech Bosses

- The Hindu: Reasonable Restrictions on Durov’s Arrest and Content Hosting

- HuffPost: France’s Arrest of Telegram CEO Pavel Durov Raises Serious Concerns

- The Guardian: What Does the Telegram Founder’s Arrest Mean for the Regulation of Social Media Companies?

- The Guardian: Arrest of Telegram CEO Pavel Durov Could Strengthen Heroic Image