Commercial Remote Sensing Satellite Market Stabilizing

Commercial Remote Sensing Satellite Market Stabilizing

Lately, trends have been leaning toward applications in urban planning and development and search-and-rescue operations. Comparative satellite imagery could also be used to track endangered species and to help protect the Earth’s natural resources.

In a new study, “The Market for Civil & Commercial Remote Sensing Satellites,” Forecast International is projecting deliveries of approximately 139 imaging satellites worth $16.3 billion over the next 10 years. The first half of the period will be more active than the second, with 97 spacecraft slated for production within the next five years.

Despite the ever-growing list of remote sensing spacecraft destined for orbit during the next 10 years, very few new players are expected to enter the commercial operator market.

The U.S. commercial remote sensing market is headed toward a period of stability thanks to the acquisition of Space Imaging by Orbimage, now known as GeoEye., without which there could be much chaos.

“The narrowing of the field from three down to two should take a burden off the U.S. government, as ensuring adequate support to all three U.S. players had been problematic,” said John Edwards, Forecast International Space Systems Editor.

“Leaning on this government support, U.S. remote sensing operators now seem content to court government business almost exclusively, as there is much less emphasis on development of the commercial base,” said Edwards. “A rebound toward the commercial side is anticipated but it’s not expected for at least another five years or more,” he added.

Through 2009 production lines will remain very active, turning out an average of 19 spacecraft per year. The overwhelming majority will be low-Earth-orbiting (LEO) satellites, with 19 such systems planned for 2006, followed by 23 in 2007 and 25 in 2008.

The value of annual LEO satellite production during the first half of the forecast period will range between $848 million at the low end and $3.2 billion at the high end. Production of the eight geostationary Earth-orbiting (GEO) spacecraft planned for the forecast period is valued at approximately $1.4 billion.

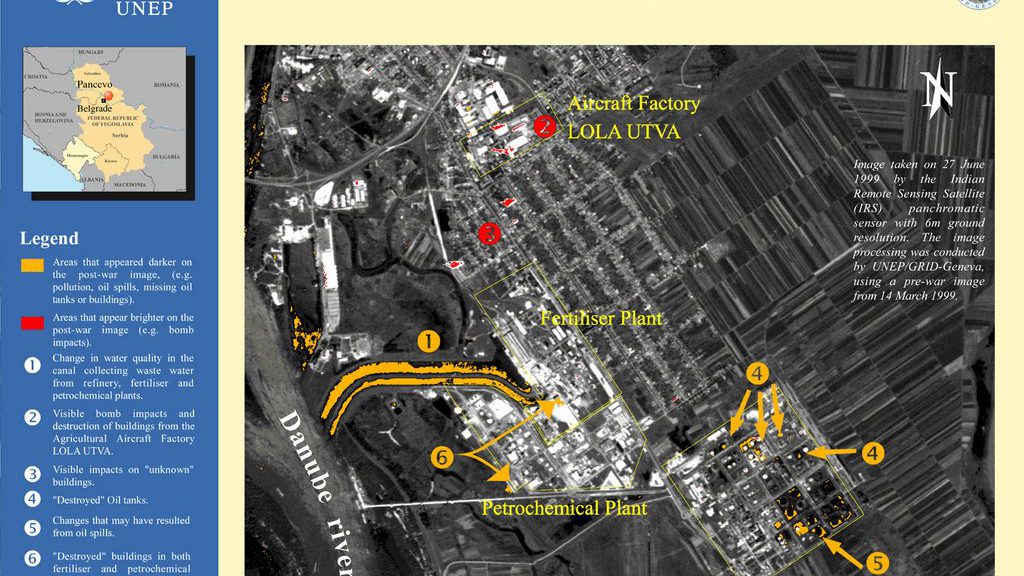

The top unit producer in the LEO remote sensing satellite market is expected to be the Indian Space Research Organization, which is forecast to supply 14 satellites over the next 10 years. “India’s production plans for remote sensing satellites are ambitious and unrivaled,” said Edwards.

“Of course, he added, “the United States has a handful of large satellites in the pipeline to serve individual companies like DigitalGlobe and GeoEye, but again, these serve individual companies, whereas the ISRO and Antrix drive the plans for Indian production.”

This centralized approach has led to one of the most powerful and cohesive satellite fleets in orbit. India currently owns and operates a fleet of six remote sensing satellites.

Over the next 10 years, as the shared aims for satellite-based imagery are realized, international cooperation on civil programs will become more mainstream. The markets for the data are myriad, starting with serving governments during wartime, engineers during development, and farmers during the growing season.

Lately, trends have been leaning toward applications in urban planning and development and search-and-rescue operations. Comparative satellite imagery could also be used to track endangered species and to help protect the Earth’s natural resources.

Competition to sell these products is fierce, and Forecast International expects this competition to spur another round of limited consolidation during the forecast period.