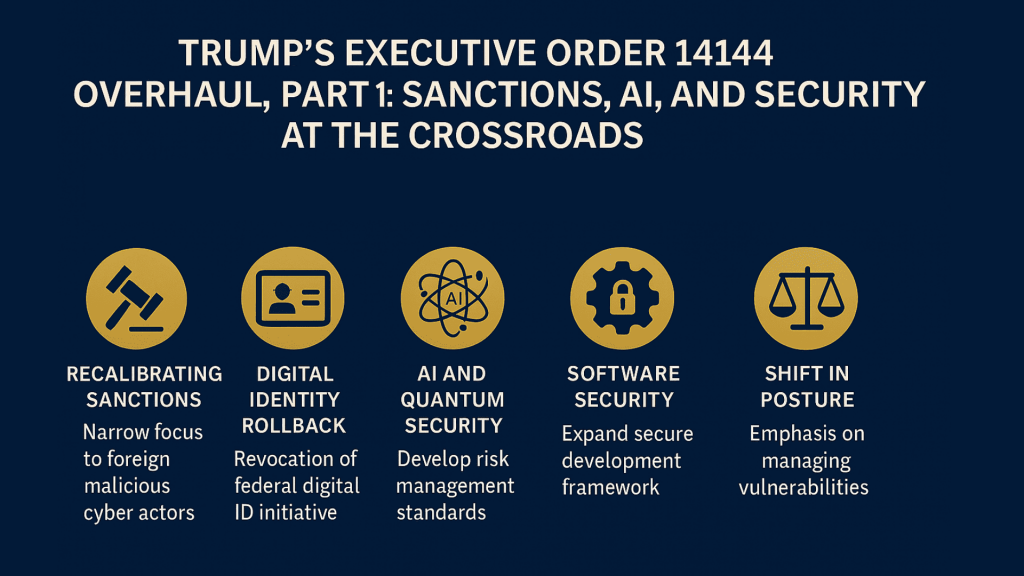

Trump’s Executive Order 14144 Overhaul, Part 1: Sanctions, AI, and Security at the Crossroads

I have been analysing cybersecurity legislation and policy for years — not just out of academic curiosity, but through the lens of a practitioner grounded in real-world systems and an observer tuned to the undercurrents of geopolitics. With this latest Executive Order, I took time to trace implications not only where headlines pointed, but also in the fine print. Consider this your distilled briefing: designed to help you, whether you’re in policy, security, governance, or tech. If you’re looking specifically for Post-Quantum Cryptography, hold tight — Part 2 of this series dives deep into that.

“When security becomes a moving target, resilience must become policy.” That appears to be the underlying message in the White House’s latest cybersecurity directive — a new Executive Order (June 6, 2025) that amends and updates the scope of earlier cybersecurity orders (13694 and 14144). The order introduces critical shifts in how the United States addresses digital threats, retools offensive and defensive cyber policies, and reshapes future standards for software, identity, and AI/quantum resilience.

Here’s a breakdown of the major components:

1. Recalibrating Cyber Sanctions: A Narrower Strike Zone

The Executive Order modifies EO 13694 (originally enacted under President Obama) by limiting the scope of sanctions to “foreign persons” involved in significant malicious cyber activity targeting critical infrastructure. While this aligns sanctions with diplomatic norms, it effectively removes domestic actors and certain hybrid threats from direct accountability under this framework.

More controversially, the order removes explicit provisions on election interference, which critics argue could dilute the United States’ posture against foreign influence operations in democratic processes. This omission has sparked concern among cybersecurity policy experts and election integrity advocates.

2. Digital Identity Rollback: A Missed Opportunity?

In a notable reversal, the order revokes a Biden-era initiative aimed at creating a government-backed digital identity system for securely accessing public benefits. The original programme sought to modernise digital identity verification while reducing fraud.

The administration has justified the rollback by citing concerns over entitlement fraud involving undocumented individuals, but many security professionals argue this undermines legitimate advancements in privacy-preserving, verifiable identity systems, especially as other nations accelerate national digital ID adoption.

3. AI and Quantum Security: Building Forward with Standards

In a forward-looking move, the order places renewed emphasis on AI system security and quantum-readiness. It tasks the Department of Defence (DoD), Department of Homeland Security (DHS), and Office of the Director of National Intelligence (ODNI) with establishing minimum standards and risk assessment frameworks for:

- Artificial Intelligence (AI) system vulnerabilities in government use

- Quantum computing risks, especially in breaking current encryption methods

A major role is assigned to NIST — to develop formal standards, update existing guidance, and expand the National Cybersecurity Centre of Excellence (NCCoE) use cases on AI threat modelling and cryptographic agility.

(We will cover the post-quantum cryptography directives in detail in Part 2 of this series.)

4. Software Security: From Documentation to Default

The Executive Order mandates a major upgrade in the federal software security lifecycle. Specifically, NIST has been directed to:

- Expand the Secure Software Development Framework (SSDF)

- Build an industry-led consortium for secure patching and software update mechanisms

- Publish updates to NIST SP 800-53 to reflect stronger expectations on software supply chain controls, logging, and third-party risk visibility

This reflects a larger shift toward enforcing security-by-design in both federal software acquisitions and vendor submissions, including open-source components.

5. A Shift in Posture: From Prevention to Risk Acceptance?

Perhaps the most significant undercurrent in the EO is a philosophical pivot: moving from proactive deterrence to a model that manages exposure through layered standards and economic deterrents. Critics caution that this may downgrade national cyber defence from a proactive strategy to a posture of strategic containment.

This move seems to prioritise resilience over retaliation, but it also raises questions: what happens when deterrence is no longer a credible or immediate tool?

Final Thoughts

This Executive Order attempts to balance continuity with redirection, sustaining selective progress in software security and PQC while revoking or narrowing other key initiatives like digital identity and foreign election interference sanctions. Whether this is a strategic recalibration or a rollback in disguise remains a matter of interpretation.

As the cybersecurity landscape evolves faster than ever, one thing is clear: this is not just a policy update; it is a signal of intent. And that signal deserves close scrutiny from both allies and adversaries alike.

Further Reading