The 3-Headed Monster of SaaS Growth: Innovation, Tech Debt, and the Compliance Black Hole

Picture this: your SaaS startup is on the verge of launching a game-changing feature. The demo with a major enterprise client is tomorrow. The team is working late, pushing final commits. Then it happens—a build breaks due to legacy code dependencies, and a critical security vulnerability is flagged. If that weren’t enough, the client just requested proof of ISO27001 certification before signing the contract. Suddenly, your momentum stalls.

Welcome to the 3-Headed Monster every scaling SaaS team faces:

- Innovation Pressure – Build fast or get left behind.

- Technical Debt – Every shortcut accumulates hidden costs.

- Compliance Black Hole – SOC 2, ISO27001, GDPR—all non-negotiables for enterprise growth.

Moderne’s recent $30M funding round to tackle technical debt is a signal: investors understand that unresolved code debt isn’t just an engineering nuisance—it’s a business risk. But addressing tech debt is only part of the battle. Winning in SaaS requires taming all three heads.

Head #1: The Relentless Demand for Innovation

In the hyper-competitive SaaS world, the mantra is clear: ship fast, or someone else will. Product-market fit waits for no one. Pressure mounts from investors, users, and competitors. Startups often prioritise speed over structure—a rational choice, but one that can quickly unravel as they scale.

As Founder of Zerberus.ai (and with past VP Eng experience at two high-growth startups), I saw us sprint ahead with rapid feature development, often knowing we were incurring technical and security debt. The goal was simple—get there first. But over time, those early shortcuts turned into roadblocks.

Increasingly, the modern CTO is no longer just a builder but a strategic leader driving business outcomes. According to McKinsey (2023), CTOs are evolving from traditional technology custodians into orchestrators of resilience, security, and scalability. This evolution means CTOs must now balance the pressure to innovate with the need to future-proof systems against both technical and security debt.

Head #2: Technical Debt – The Silent Killer

Every startup understands technical debt, but few realise its full cost until it’s too late. It slows feature releases, increases defect rates, and leads to developer burnout. More critically, it introduces security vulnerabilities.

A 2020 report by the Consortium for Information & Software Quality (CISQ) estimated that poor software quality cost U.S. businesses $2.41 trillion, with technical debt being a major contributor. This loss of velocity directly impacts innovation and time to market.

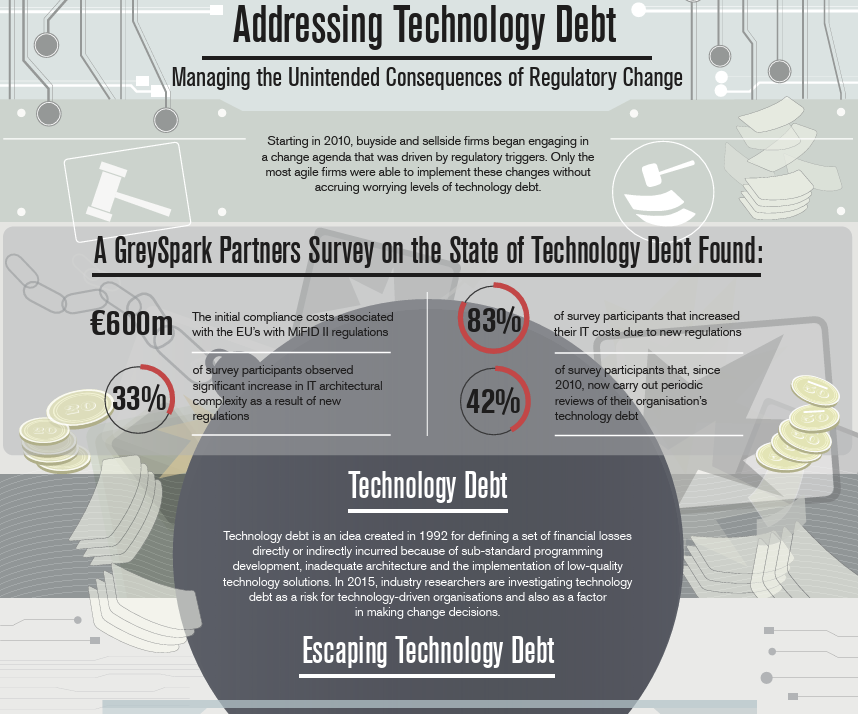

GreySpark Partners (2023) highlights that over 60% of firms struggle with technology debt, impacting their ability to innovate. Alarmingly, they found that 71% of respondents believed their technology debt would negatively affect their firm’s competitiveness in the next five years.

The Spring4Shell vulnerability in 2022 was a stark reminder—outdated dependencies can expose your entire stack. Moderne’s approach—automating large-scale refactoring—is promising because it acknowledges a core truth: technical debt isn’t just a productivity issue; it’s a security and revenue risk.

Head #3: The Compliance Black Hole

ISO27001, SOC 2, GDPR. These aren’t just badges of honour; they are the price of admission for enterprise deals. Yet compliance often blindsides startups. It’s seen as a box-ticking exercise, rushed through to close deals. But achieving compliance is only the beginning—staying compliant is the real challenge.

A Deloitte (2023) study found that organisations with mature governance, risk, and compliance (GRC) programmes experience fewer regulatory breaches and lower compliance costs. Furthermore, McKinsey (2023) highlights that cybersecurity in the AI era requires embedding security into product development as early as possible, as threats evolve in tandem with technological progress.

I’ve been in rooms where six-figure deals were delayed because we didn’t have the right certifications. In other cases, a sudden audit exposed weak controls, forcing an all-hands firefight. Compliance isn’t just a legal requirement; it’s a potential growth blocker.

Where the 3 Heads Collide

These challenges are deeply interconnected:

- Innovation leads to technical debt.

- Technical debt creates security vulnerabilities.

- Security gaps jeopardise compliance.

This vicious cycle can trap startups in firefighting mode. The solution lies in convergence:

- Automate code health (e.g., Moderne).

- Embed security into development (Shift Left, SAST, Dependency Scanning).

- Integrate compliance into engineering workflows (continuous compliance).

Forward-thinking teams realise that innovation, security, and compliance are not separate lanes; they are parallel tracks that must move in sync.

The Future: Taming the Monster

Investors are betting on platforms that tackle technical debt and automate security posture. The future CTO will not just manage code velocity; they will oversee code health, security, and compliance as a unified system.

Winning in SaaS is no longer just about shipping fast—it’s about shipping fast, securely, and in compliance. The real winners will tame all three heads.

At Zerberus.ai—founded by engineers and security experts from high-growth SaaS startups like Zarget and Itilite—we are exploring how startups can simplify security compliance while enabling rapid development. We’re currently in private beta, partnering with SaaS teams tackling these challenges.

Trivia: Our logo, inspired by Cerberus—the mythical three-headed guardian of the underworld—embodies this very struggle. Each head symbolises the core challenges startups face: Innovation, Technical Debt, and Compliance. Zerberus.ai is built to help startups tame each of these heads, ensuring that rapid growth doesn’t come at the expense of security or scalability.

How are you navigating the 3-Headed Monster in your startup journey?

References and Further Reading

- Moderne Raises $30M to Solve Technical Debt Across Complex Codebases: https://techcrunch.com/2025/02/11/moderne-raises-30m-to-solve-technical-debt-across-complex-codebases/

- The Log4Shell Vulnerability Explained: https://www.cisa.gov/uscert/ncas/alerts/aa21-356a

- Spring4Shell Vulnerability: https://spring.io/blog/2022/03/31/spring-framework-rce-early-announcement

- ISO27001 Certification: https://www.iso.org/isoiec-27001-information-security.html

- SOC 2 Compliance Overview: https://www.aicpa-cima.com/resources/press-release/soc-2-audit-requirements

- CISQ (Consortium for Information & Software Quality). (2020). The Cost of Poor Quality Software in the US: A 2020 Report. https://www.it-cisq.org/cost-of-poor-software-quality.htm

- Deloitte. (2023). SAP GRC: Governance, Risk, and Compliance for Effective Risk Management. https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/risk/sea-risk-sap-grc-governance-risk-compliance-effective-risk-management.pdf

- McKinsey. (2023). A New Dawn for the Technology Officer. https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/a-new-dawn-for-the-technology-officer

- McKinsey. (2023). The Cybersecurity Provider’s Next Opportunity: Making AI Safer. https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/the-cybersecurity-providers-next-opportunity-making-ai-safer

- GreySpark Partners. (2023). Technology Debt Infographic. https://www.greyspark.com/wp-content/uploads/Technology-Debt-infographic.pdf