Starling Bank’s Penalty: How to Strengthen Your Compliance Efforts

Introduction

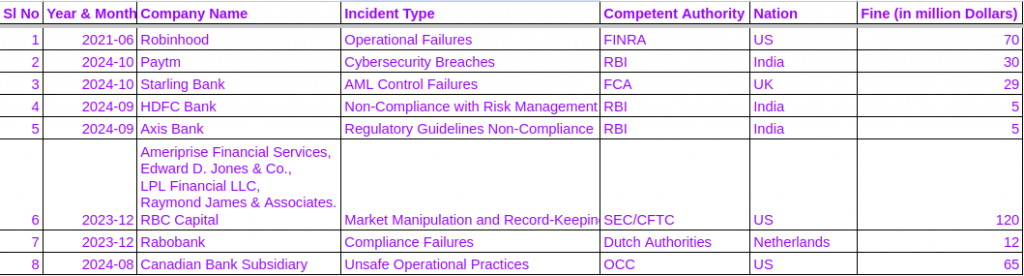

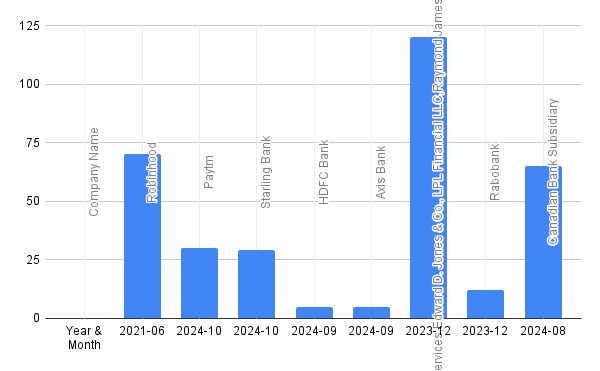

The rapid growth of the fintech industry has brought with it immense opportunities for innovation, but also significant risks in terms of regulatory compliance and real security. Starling Bank, one of the UK’s prominent digital banks, recently faced a £29 million fine in October 2024 from the Financial Conduct Authority (FCA) for serious lapses in its anti-money laundering (AML) and sanctions screening processes. This fine is part of a broader trend of fintechs grappling with regulatory pressures as they scale quickly. Failures in compliance not only lead to financial penalties but also damage to reputation and customer trust. In most cases, it also leads to revenue loss and or a significant business impact.

In this article, we explore what went wrong at Starling Bank, examine similar compliance issues faced by other major financial institutions like Paytm, Monzo, HDFC, Axis Bank & RobinHood and propose practical solutions to help fintech companies strengthen their compliance frameworks. This also helps to establish the point that these cybersecurity and compliance control lapses are not restricted to geography and are prevalent in the US, UK, India and many other regions. Additionally, we dive into how vulnerabilities manifest in growing fintechs and the increasing importance of adopting zero-trust architectures and AI-powered AML systems to safeguard against financial crime.

Background

In October 2024, Starling Bank was fined £29 million by the Financial Conduct Authority (FCA) for significant lapses in its anti-money laundering (AML) controls and sanctions screening. The penalty highlights the increasing pressure on fintech firms to build robust compliance frameworks that evolve with their rapid growth. Starling’s case, although high-profile, is just one in a series of incidents where compliance failures have attracted regulatory action. This article will explore what went wrong at Starling, examine similar compliance failures across the global fintech landscape, and provide recommendations on how fintechs can enhance their security and compliance controls.

What Went Wrong and How the Vulnerability Manifested

The FCA investigation into Starling Bank uncovered two major compliance gaps between 2019 and 2023, which exposed the bank to financial crime risks:

- Failure to Onboard and Monitor High-Risk Clients: Starling’s systems for onboarding new clients, particularly high-risk individuals, were not sufficiently rigorous. The bank’s AML mechanisms did not scale in line with the rapid increase in customers, leaving gaps where sanctioned or suspicious individuals could go undetected. Despite the bank’s growth, the compliance framework remained stagnant, resulting in breaches of Principle 3 of the FCA’s regulations for businesses(Crowdfund Insider)(FinTech Futures).

- Inadequate Sanctions Screening: Starling’s sanctions screening systems failed to adequately identify transactions from sanctioned entities, a critical vulnerability that persisted for several years. With insufficient real-time monitoring capabilities, the bank did not screen many transactions against the latest sanctions lists, leaving it exposed to potentially illegal activity(FinTech Futures). This is especially concerning in a financial ecosystem where transactions are frequent and high in volume, requiring robust systems to ensure compliance at all times.

These vulnerabilities manifested in Starling’s inability to effectively prevent financial crime, culminating in the FCA’s action in October 2024.

Learning from Similar Failures in the Fintech Industry

- Paytm’s Cybersecurity Breach Reporting Delays (October 2024): In India, Paytm was fined for failing to report cybersecurity breaches in a timely manner to the Reserve Bank of India (RBI). This non-compliance exposed vulnerabilities in Paytm’s internal governance structures, particularly in their failure to adapt to rapid business expansion and manage cybersecurity threats(Reuters).

- HDFC and Axis Banks’ Regulatory Breaches (September 2024): The RBI fined HDFC Bank and Axis Bank in September 2024 for failing to comply with regulatory guidelines, emphasizing how traditional banks, like fintechs, can face compliance challenges as they scale. The fines were related to lapses in governance and risk management frameworks(Economic Times).

- Monzo’s PIN Security Breach (2023): In 2023, UK-based challenger bank Monzo experienced a breach where customer PINs were accidentally exposed due to an internal vulnerability. Although Monzo responded swiftly to mitigate the damage, the breach illustrated the need for fintechs to prioritize backend security and implement zero-trust security architectures that can prevent such incidents(Wired).

- LockBit Ransomware Attack (2024): The LockBit ransomware attack on a major financial institution in 2024 demonstrated the growing cyber threats that fintechs face. This attack exposed the weaknesses in traditional cybersecurity models, underscoring the necessity of adopting zero-trust architectures for fintech companies to protect sensitive data and transactions from malicious actors(NCSC).

- Robinhood’s Regulatory Scrutiny (2021-2022): In June 2021, Robinhood was fined $70 million by FINRA for misleading customers, causing harm through platform outages, and failing to manage operational risks during the GameStop trading frenzy. Robinhood’s systems were not equipped to handle the surge in trading volumes, leading to severe service disruptions and a failure to communicate risks to customers.

- Robinhood Crypto’s Cybersecurity Failure (2022): In August 2003, Robinhood was fined $30 million by the New York State Department of Financial Services (NYDFS) for failing to comply with anti-money laundering (AML) regulations and cybersecurity obligations related to its cryptocurrency trading operations. The fine was issued due to inadequate staffing, compliance failures, and improper handling of regulatory oversight within its crypto business. Much like Starling, Robinhood’s compliance systems lagged behind its rapid business growth (Compliance Week)

Key Statistics in the Fintech Compliance Landscape

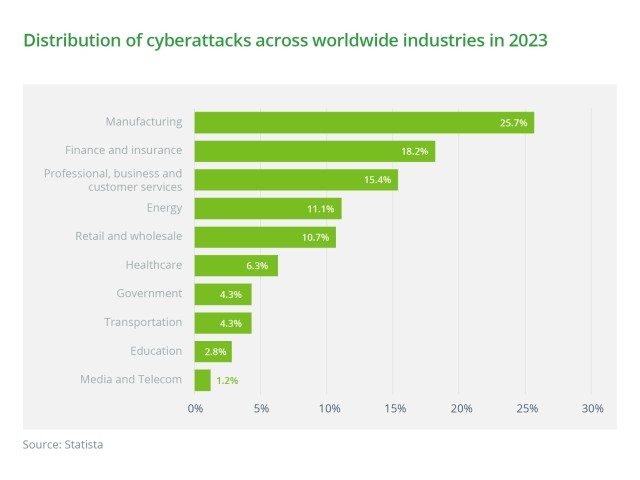

- 65% of organizations in the financial sector had more than 500 sensitive files open to every employee in 2023, making them highly vulnerable to insider threats.

- The average cost of a data breach in financial services was $5.85 million in 2023, a significant figure that shows the financial impact of security vulnerabilities.

- 27% of ransomware attacks targeted financial institutions in 2022, with the number of attacks continuing to rise in 2024, further highlighting the importance of robust cybersecurity frameworks.

- 81% of financial institutions reported a rise in phishing and social engineering attacks in 2023, emphasizing the need for employee awareness and strong access controls.

- By 2025, the global cost of cybercrime is projected to exceed $10.5 trillion annually, a figure that will disproportionately impact fintech companies that fail to implement strong security protocols.

Recommendations for Strengthening Compliance and Security Controls

To prevent future compliance breaches, fintech firms should prioritise scalable, technology-enabled compliance solutions. This requires empowering Compliance Heads, Information Security Teams, CISOs, and CTOs with the necessary budgets and authority to develop secure-by-design environments, teams, infrastructure, and products.

- AI-Powered AML Systems: Leverage artificial intelligence (AI) and machine learning to enhance AML systems. These technologies can dynamically adjust to new threats and process high volumes of transactions to detect suspicious patterns in real time. This approach will ensure that fintechs can comply with evolving regulatory requirements while scaling.

- Zero-Trust Security Models: As the LockBit ransomware attack showed in 2024, fintechs must adopt zero-trust architectures, where every user and device interacting with the system is continuously authenticated and verified. This reduces the risk of internal breaches and external attacks(Cloudflare).

- Real-Time Auditing and Blockchain for Transparency: Real-time auditing, combined with blockchain technology, provides an immutable and transparent record of all financial transactions. This would help fintechs like Starling avoid the pitfalls of delayed sanctions screening, as blockchain ensures immediate and traceable compliance checks(EY).

- Multi-Layered Sanctions Screening: Implement a multi-layered sanctions screening system that combines automated transaction monitoring with manual oversight for high-risk accounts. This dual approach ensures that fintechs can monitor suspicious activities while maintaining compliance with global regulatory frameworks(Exiger)(FinTech Futures).

- Continuous Employee Training and Governance: Strong governance structures and regular compliance training for employees will ensure that fintechs remain agile and responsive to regulatory changes. This prepares the organization to adapt as new regulations emerge and customer bases expand.

Conclusion

The £29 million fine imposed on Starling Bank in October 2024 serves as a crucial reminder for fintech companies to integrate robust compliance and security frameworks as they grow. In an industry where regulatory scrutiny is intensifying, the fintech players that prioritize compliance will not only avoid costly fines but also position themselves as trusted institutions in the financial services world.

Further Reading and References

- RBI Fines HDFC, Axis Bank for Non-Compliance with Regulations (September 2024)

- RBI Fines Paytm for Not Reporting Cybersecurity Breaches on Time (October 2024)

- LockBit’s Latest Attack Shows Why Fintech Needs More Zero Trust (2024)

- Monzo PIN Security Breach Explained (2023)

- Varonis Cybersecurity Statistics (2023)

Scholarly Papers & References

- Barr, M.S.; Jackson, H.E.; Tahyar, M. Financial Regulation: Law and Policy. SSRN Scholarly Paper No. 3576506, 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3576506

- Suryono, R.R.; Budi, I.; Purwandari, B. Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information 2020, 11, 590. https://doi.org/10.3390/info11120590

- AlBenJasim, S., Dargahi, T., Takruri, H., & Al-Zaidi, R. (2023). FinTech Cybersecurity Challenges and Regulations: Bahrain Case Study. Journal of Computer Information Systems, 1–17. https://doi.org/10.1080/08874417.2023.2251455

By learning from past failures and adopting stronger controls, fintechs can mitigate the risks of financial crime, protect customer data, and ensure compliance in an increasingly regulated industry.