The Truth About “Ghost Engineers”: A Critical Analysis

Disclaimer:

This article is not intended to discredit Boris Denisov, Stanford University, McKinsey, or any other entities referenced herein. I hold immense respect for their contributions to research and industry discourse. While findings like these may resonate with practices in FAANG companies, large organizations, and mature startups, this critique seeks to explore the broader implications of relying on narrow metrics to evaluate productivity in software engineering.

The “Ghost Engineer” Narrative

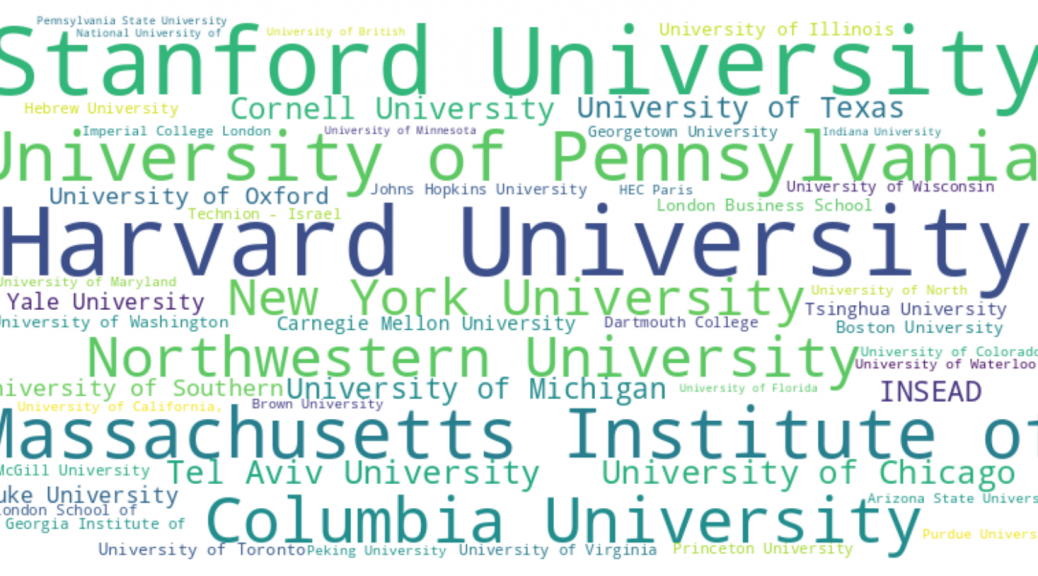

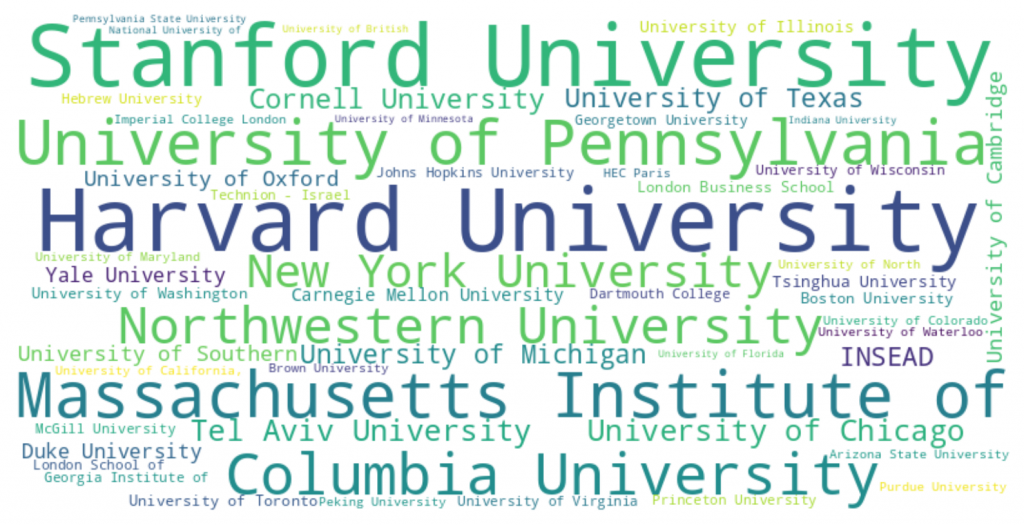

The term “ghost engineers,” popularized by a recent Stanford study, describes software engineers who allegedly contribute minimally to codebases. Analyzing data from over 50,000 engineers, the study concludes that 9.5% of engineers fall into this category, with the prevalence rising to 14% among remote workers.

While the findings spark interesting discussions, they rely heavily on the flawed assumption that code commit frequency equates to productivity. As I argued in No, McKinsey, You Got It All Wrong About Developer Productivity, this narrow perspective risks undervaluing critical aspects of software engineering that don’t leave a visible footprint in version control systems.

Unintended Amplification: The Snowball Effect

One of the most significant risks of such conclusions—especially before peer review—is their unintended amplification. Articles on Yahoo, TechCrunch, and Newsday have already simplified these findings, creating narratives that could ripple through the industry:

- Unnecessary Layoffs: Misinterpreting data might lead organizations to hastily classify engineers as unproductive, ignoring less visible but valuable contributions.

- Remote Work Stigma: By associating remote work with reduced productivity, these claims risk undermining one of the most effective workforce models when well-managed.

- Toxic Metrics Culture: Over-reliance on activity metrics like commit counts can encourage engineers to game the system by prioritizing volume over meaningful work, as discussed in Business Value Delivery by Engineering Teams in Startups (Part 2).

History offers cautionary examples, such as McKinsey’s controversial reliance on lines of code as a productivity measure—a practice criticized in my earlier article for ignoring the multifaceted nature of modern software engineering.

Engineering Productivity: Beyond Output Metrics

As outlined in Is the Myth of a 10x Developer Real?, productivity in software engineering extends far beyond raw output. Effective engineers don’t just code—they align stakeholders, resolve ambiguity, and reduce future risks. These invisible contributions often lead to:

- Improved Collaboration: Engineers who mentor, review code, or resolve cross-team dependencies amplify the impact of their teams.

- Strategic Outcomes: Refactoring technical debt or implementing security frameworks might reduce visible code output while significantly improving system health.

Commit Frequency Misses Critical Context

- Quality Over Quantity: A single commit that eliminates 1,000 lines of redundant code can be more impactful than 10 minor feature updates.

- Diverse Roles: Roles like DevOps, QA, and security often contribute indirectly to engineering success but rarely generate frequent commits.

By focusing solely on visible metrics, we risk reinforcing flawed incentives, a point I emphasized in Business Value Delivery by Engineering Teams in Startups (Part 1).

Analyzing the Stanford Study’s Claims

Claim 1: Engineers with Low Commit Activity Are Unproductive

Rebuttal: This assumption ignores the cognitive and collaborative aspects of engineering. As noted in No, McKinsey, You Got It All Wrong About Developer Productivity, activities like design discussions, documentation, and mentoring are essential but invisible in commit logs.

Claim 2: Remote Engineers Are More Likely to Be “Ghost Engineers”

Rebuttal: Remote work relies on asynchronous collaboration, where documentation and long-term planning take precedence over immediate outputs. Simplistic comparisons risk stigmatizing effective remote models.

Claim 3: Low Commit Activity Correlates with Poor Team Performance

Rebuttal: High-performing teams often include specialists whose contributions are less visible but critical. For example, a security engineer resolving vulnerabilities or a DevOps engineer optimizing CI/CD pipelines may not show up in commit logs.

Claim 4: Organizations Could Save Billions by Addressing the “Ghost Engineer” Problem

Rebuttal: Cost-cutting measures based on flawed metrics often lead to higher technical debt, increased turnover, and diminished morale. As argued in Business Value Delivery by Engineering Teams in Startups (Part 2), true cost efficiency lies in maximizing impact, not minimizing headcount.

Impact vs Code-Commits: Understanding the Misalignment

A recurring issue with productivity metrics like code-commit frequency is their inability to reflect the true impact of an engineer’s work. The volume of code changes often says little about the value delivered, as demonstrated by the following examples:

Example 1: A Cosmetic UI Change vs. A Critical API Update

Imagine a product manager requests a seemingly simple change: update a button’s color from purple to orange. While this may sound trivial, it could involve:

- Updating CSS libraries: A cascade of dependencies might require 1,000+ lines of revisions.

- Testing for accessibility: Ensuring compliance with color-contrast guidelines adds complexity.

- Regression testing: Updating snapshot tests or fixing broken visual diffs.

This cosmetic change could result in dozens of commits, each addressing a specific dependency or edge case.

Contrast this with a backend engineer’s work on the API gateway to improve application concurrency. This might involve:

- Identifying bottlenecks: Profiling existing workloads and implementing a solution to reduce latency.

- Optimizing database connections: Reducing round trips or improving query performance.

- Deploying with minimal disruption: A single, concise commit could encapsulate weeks of planning and testing.

Here, the backend change’s impact far outweighs the UI update, even though it appears smaller in terms of commit frequency.

Example 2: Bulk Refactoring vs. Precise Bug Fixing

A mid-level engineer is tasked with refactoring a legacy module, updating deprecated methods, and restructuring a monolithic codebase for better readability. This effort generates hundreds of commits and thousands of lines of changes, none of which immediately improve the product’s features.

On the other hand, a senior engineer identifies and fixes a critical bug that intermittently crashes the application. The solution, a one-line code change after hours of debugging, resolves a high-severity issue affecting thousands of users.

From a commit-count perspective, the refactoring task appears more productive. However, the senior engineer’s single-line fix has a far greater immediate impact.

Example 3: Feature Addition vs. Security Enhancement

A frontend developer introduces a new feature, such as a user profile editor. This entails:

- New UI components: HTML and CSS for the form.

- Frontend validations: JavaScript-based constraints for data inputs.

- Integration tests: Mock API responses for various test cases.

The addition spans 2,000 lines of code across 20 commits.

Meanwhile, a DevSecOps engineer works on a critical security vulnerability. The task involves:

- Rotating access tokens: Updating key secrets stored in the CI/CD pipeline.

- Implementing security headers: Adding CSPs to prevent XSS attacks.

- Hardening configurations: Minor changes in deployment scripts to reduce attack surfaces.

Although the security enhancement generates fewer than 10 commits, its value in preventing potential breaches and compliance penalties is enormous.

Key Takeaways

- Context Matters: Evaluating productivity requires understanding the context and complexity of the task, not just the output volume.

- Quality Over Quantity: High-impact changes often involve fewer commits, while low-value tasks may inflate commit counts.

- Recognizing Diverse Contributions: Engineers working on performance, security, or architecture frequently produce less visible yet highly impactful work.

This misalignment underscores the need for organizations to adopt holistic evaluation metrics that consider both quantitative output and qualitative impact. By focusing on the latter, teams can better recognize and reward meaningful contributions.

The Danger of Flawed Productivity Metrics

Simplistic metrics can have cascading negative effects:

- Burnout: Engineers may feel pressured to prioritize activity over quality.

- Stifled Innovation: Overemphasis on visible output discourages experimentation and risk-taking.

- Loss of Talent: Talented engineers in specialized roles may leave if their contributions are undervalued.

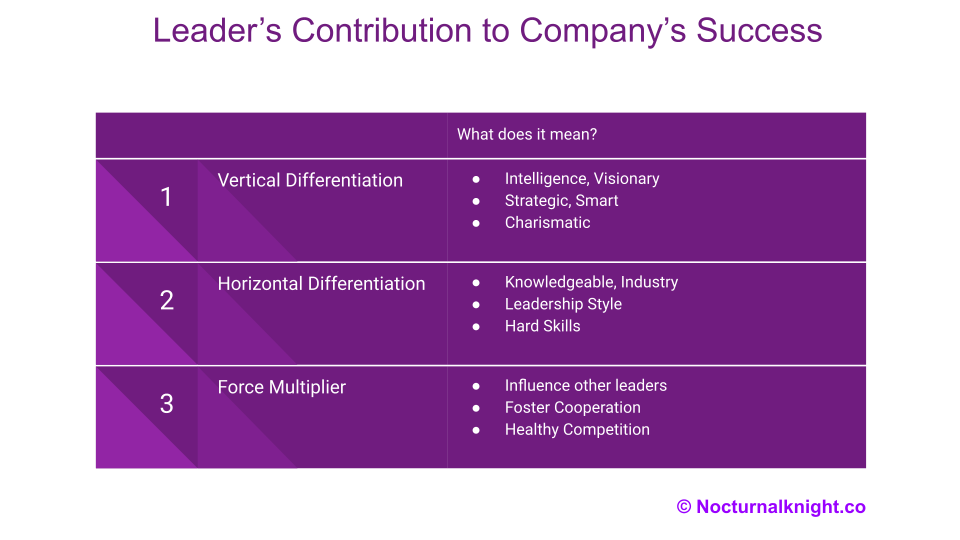

As emphasized in Is the Myth of a 10x Developer Real?, effective engineering is about multiplying impact, not maximizing visible output.

A Holistic Approach to Productivity

To address these issues, organizations must adopt nuanced evaluation frameworks:

- Impact-Driven Metrics: Evaluate contributions based on outcomes, such as improved system reliability or customer satisfaction.

- Recognize Invisible Work: Acknowledge tasks like mentorship, technical debt reduction, and long-term strategic planning.

- Foster a Culture of Trust: Empower teams to experiment and innovate without fear of being misjudged by flawed metrics.

Conclusion

The “ghost engineer” narrative oversimplifies the multifaceted nature of software engineering. By relying on metrics like commit counts, it risks undervaluing critical contributions and fostering unhealthy workplace dynamics. As I’ve argued across multiple articles, effective engineering teams succeed by delivering value, not just output. The industry must move beyond flawed productivity metrics and adopt more comprehensive frameworks to recognize the true contributions of every engineer.

References and Further Reading

- Denisov-Blanch, Y. (2024). Twitter Thread on Ghost Engineers. Retrieved from link.

- Denisov-Blanch, Y. (2024). Stanford Research on Software Engineering Productivity. Stanford University. Retrieved from link.

- Polyakov, A. (2024). Ghost Engineers—Utter Non-Sense! Medium. Retrieved from link.

- No, McKinsey, You Got It All Wrong About Developer Productivity. Nocturnalknight.co. Retrieved from link.

- Is the Myth of a 10x Developer Real? Nocturnalknight.co. Retrieved from link.

- Bridgwater, A. (2024). Code Busters: Are Ghost Engineers Haunting DevOps Productivity? DevOps.com. Retrieved from link.

- Business Value Delivery by Engineering Teams in Startups (Part 1). Nocturnalknight.co. Retrieved from link.

- Business Value Delivery by Engineering Teams in Startups (Part 2). Nocturnalknight.co. Retrieved from link.

- Long, K. (2024). Are Ghost Engineers Undermining Tech Productivity? Business Insider. Retrieved from link.

- Passionate Geekz. (2024). Can a Company Increase Its Market Value by Laying Off Employees? Retrieved from link.